Launch web applications

10x faster with LoftOS

Still stuck waiting to hear back from IT? Forget traditional tech delays.

We're making digitalization quicker, easier, and way more affordable.

Fueling digitalization for the world's top organizations

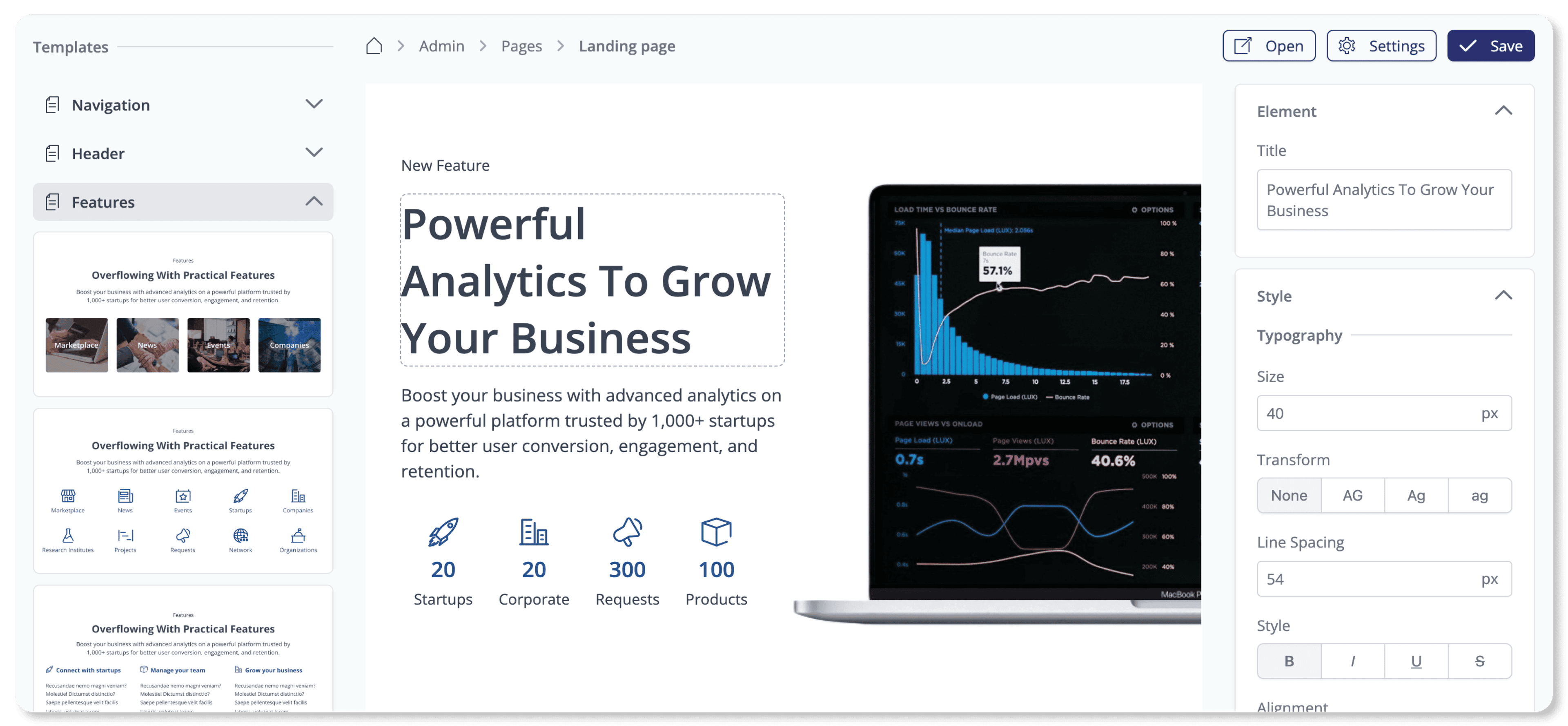

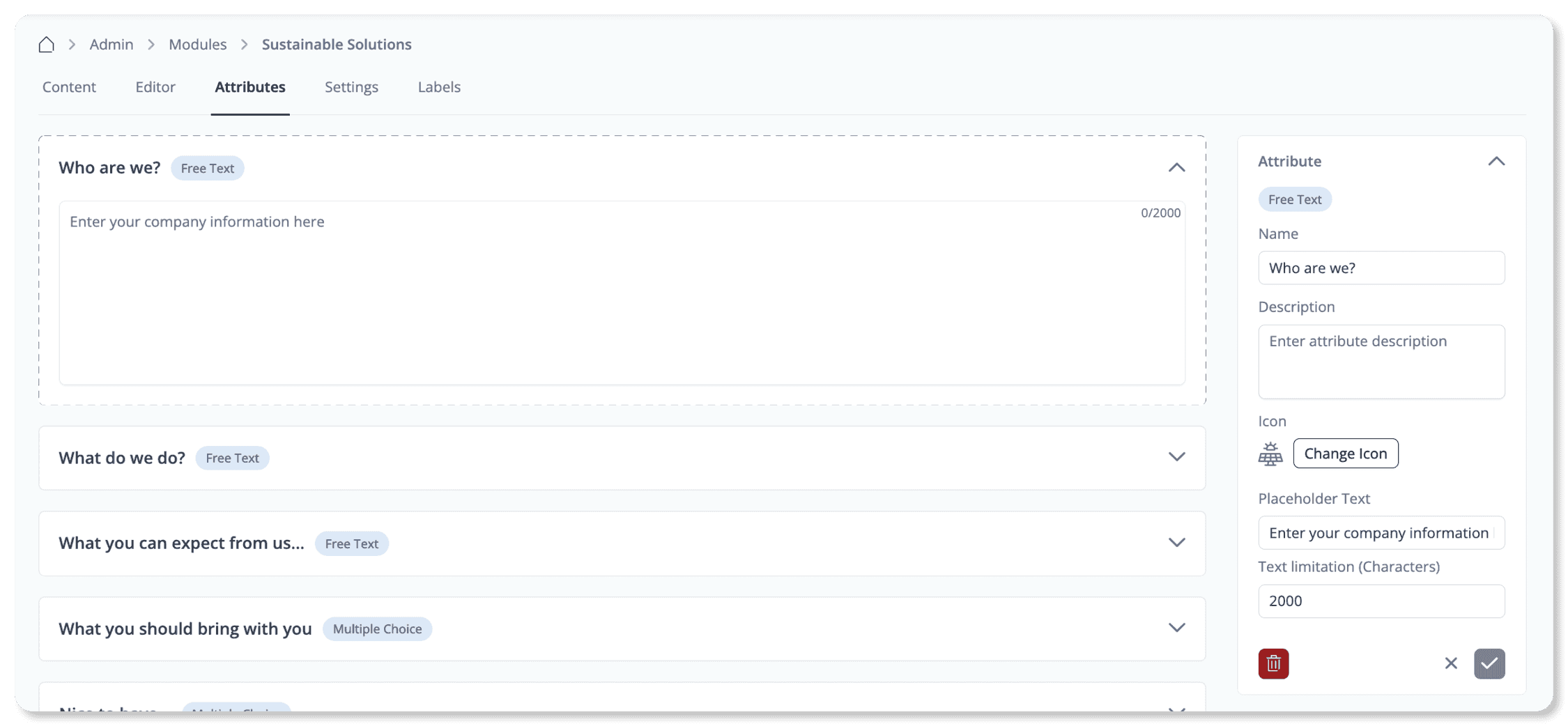

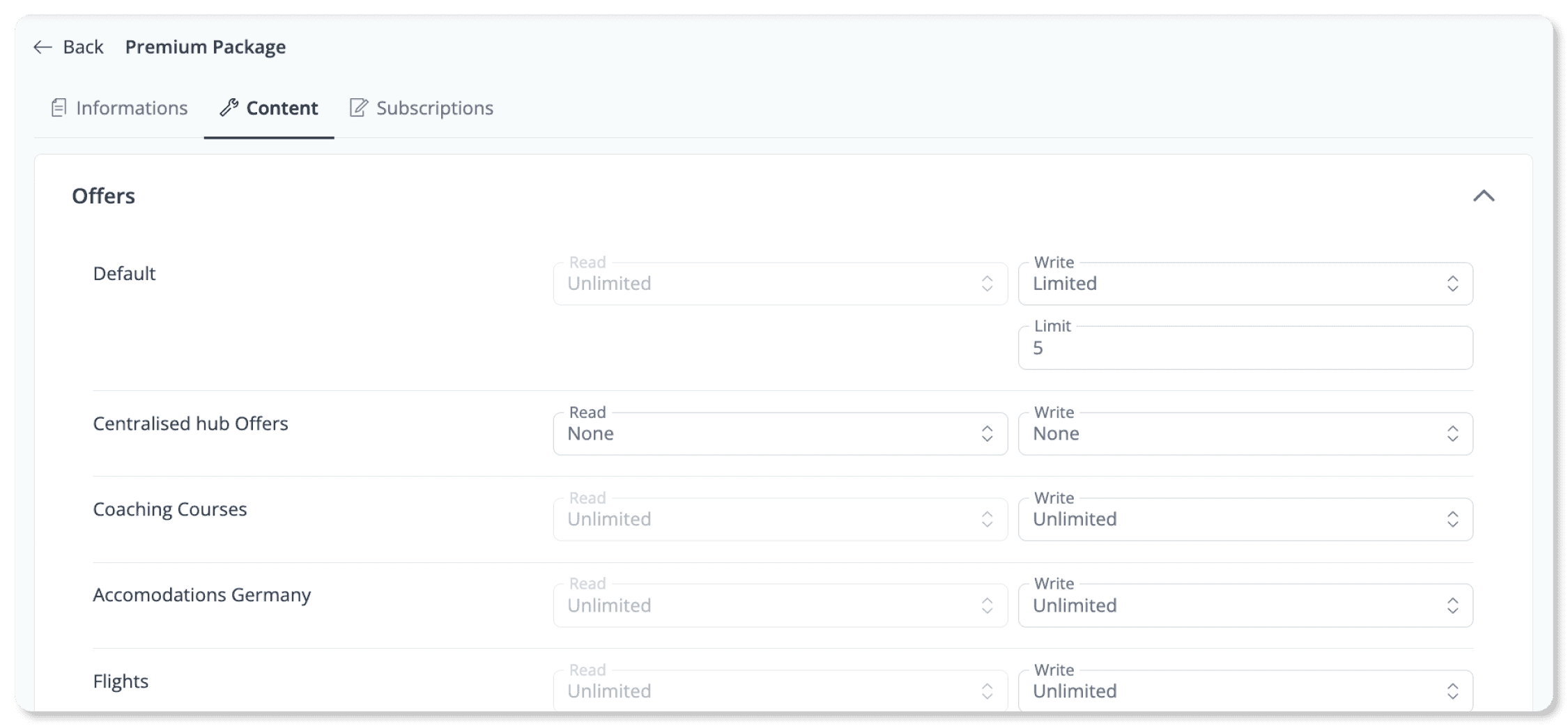

Be your own developer

With LoftOS, you’re in control. Build web applications like networks, marketplaces, or internal tools all without writing a single line of code. Forget about juggling multiple tools or expensive IT agencies.

Fast-track your

digitalization journey

Don’t waste time in month-long development projects. Go live instantly with our no-code development platform.

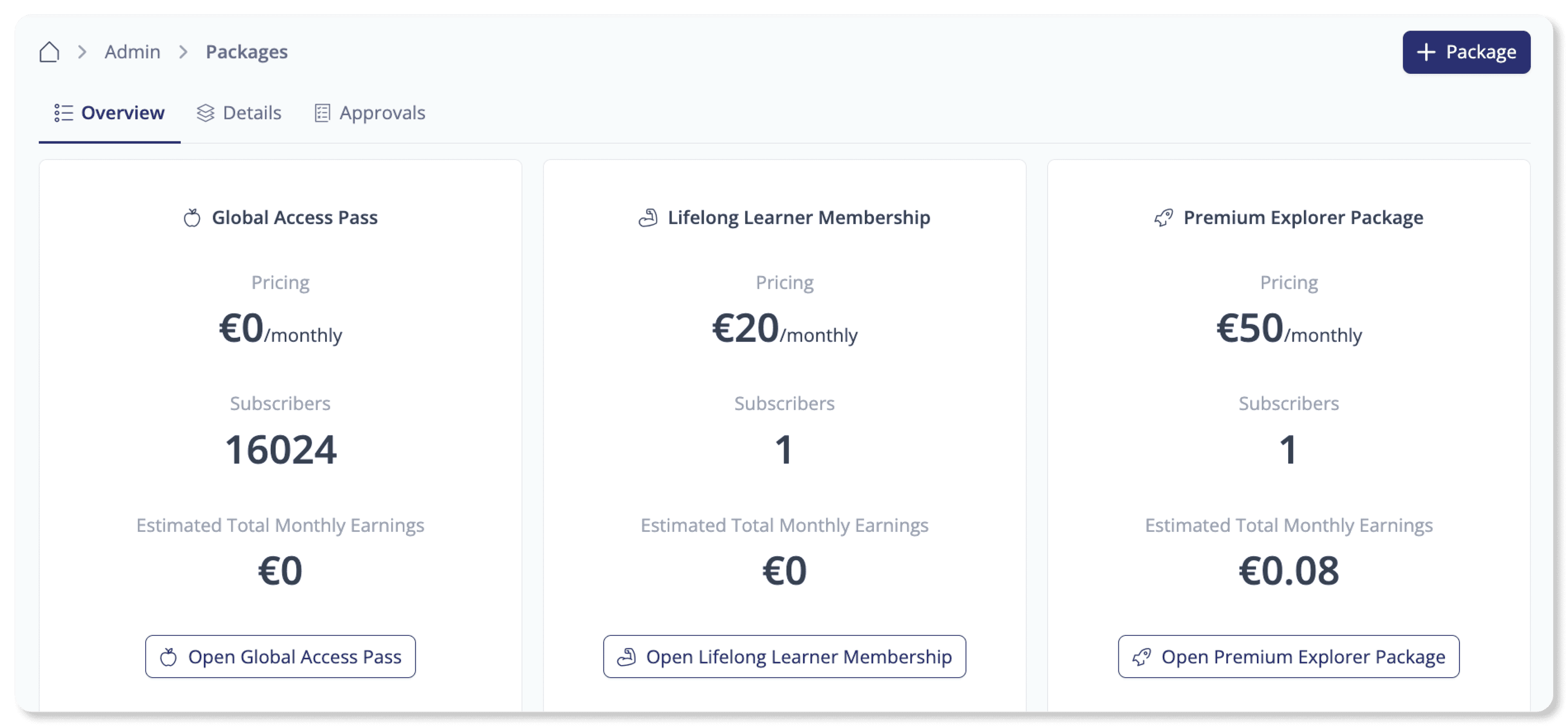

Cut software dev costs by 80% with no-code flexibility

Stop overpaying for complex IT projects. Don’t worry about escalating costs. All the features you need, none you don’t — starting at €349/month

Check out how others use LoftOS

Public economic development

Transform your business ecosystem from analog to digital. With LoftOS, you’re not just increasing transparency — you’re unlocking a world of exciting business opportunities.

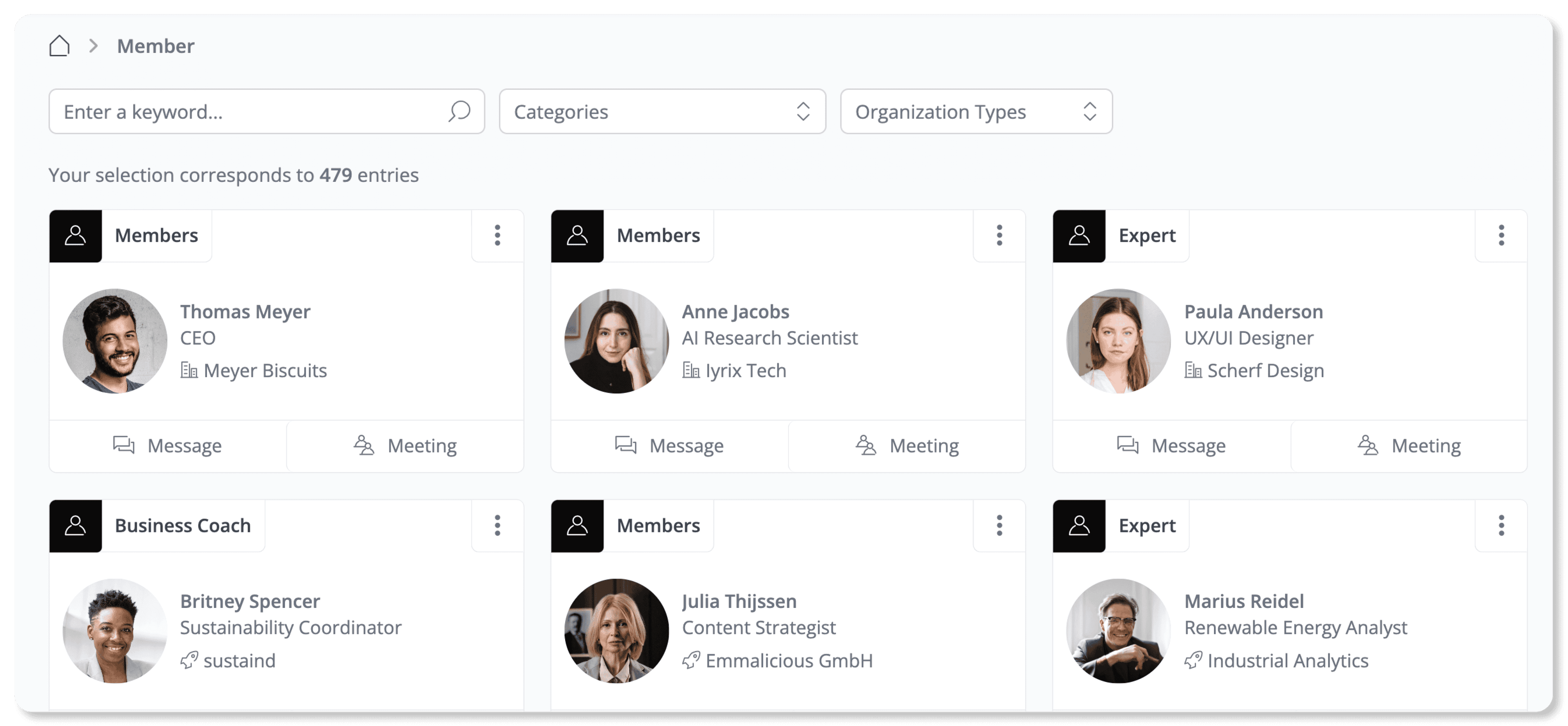

Community management

Ditch outdated community management. With LoftOS, anchor your members to a digital hub packed with digital tools that make every click count.

Research transfer

Don’t just showcase your research, monetize it. With LoftOS, you can effortlessly connect your skills, services, and technologies to industry leaders who are actively looking to invest.

Innovation management

Build a digital ecosystem that attracts technology leaders and set the stage for groundbreaking innovation.

Don't see your use case above? No worries, LoftOS adapts to any business need.

Browse our ever-expanding template library to kick-start your journey or

chat 1-on-1 with a LoftOS specialist to craft a 100% customized web solution.